RESULTS

Market-first Innovations

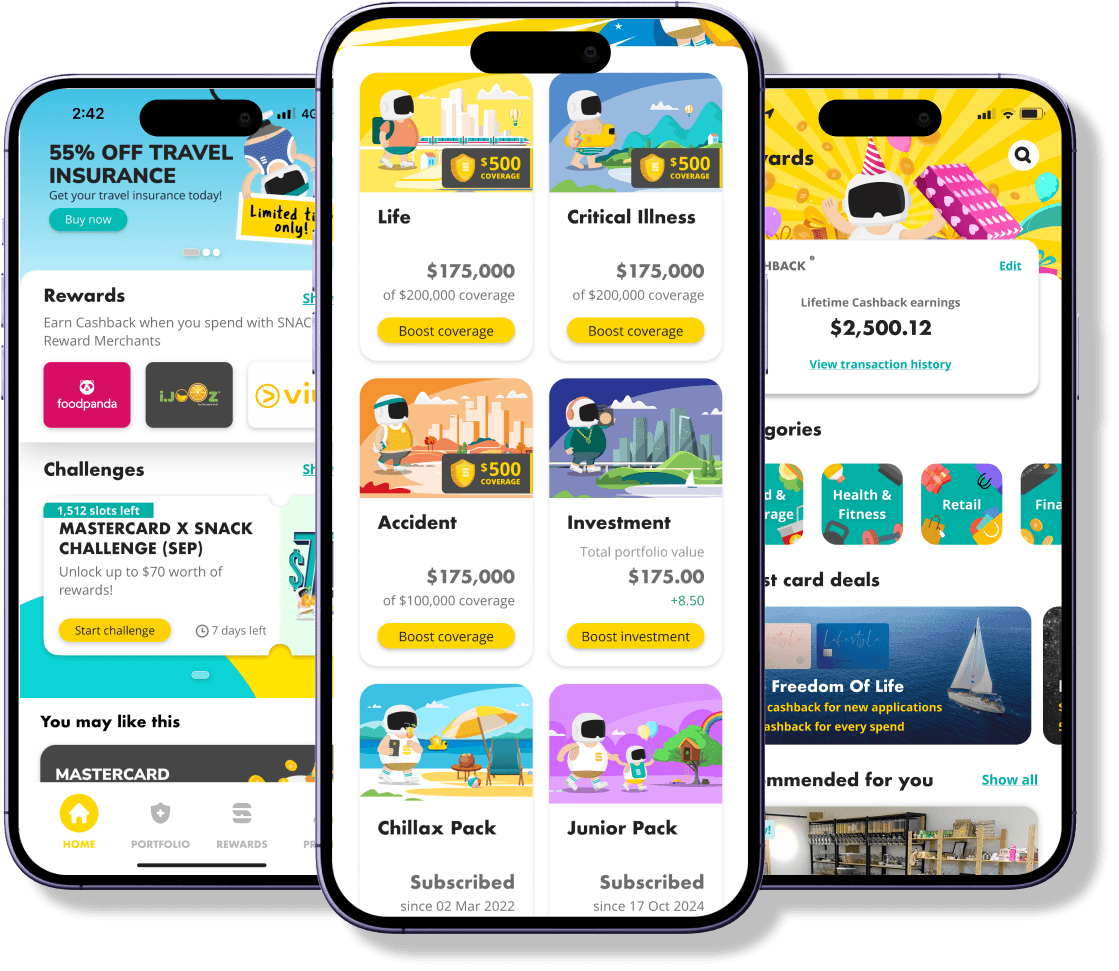

Pioneered the first financial lifestyle app with stackable micro-insurance.

110K+ Active Users

Built a growing community within the SNACK ecosystem, issuing millions of policies.

150+ Ecosystem Partners

Partnered with a diverse range of ecosystem partners, including banks and restaurants, to boost engagement through gamification.

New Market Segment

Unlocked a new demographic (avg. age 33), making protection more accessible to younger generations.

About Company

Income Insurance, a leading composite insurers in Singapore, offering life, health, and general insurance for more than 1.4 million customers. Its lifestyle-centric and data-driven approach to insurance and financial planning puts them at the forefront of innovative solutions that empower the people it serves, including underserved groups, with better financial well-being.

The Requirements

Traditional insurers face the challenge of low customer engagement, especially among younger demographics. Income Insurance aimed to tackle this issue and attract the underserved young customer segment by making insurance more affordable, relevant, and convenient for these groups. Income Insurance wanted to launch a new financial lifestyle app, allowing customers to build and earn insurance coverage and investment portfolios as they go about their daily activities such as buying coffee, taking public transport or clocking in a step. The aim was to offer flexible, highly personalized coverage that aligns with customers' lifestyles, without the burden of hefty premiums or long lock-in periods.

To achieve this, Income needed a digital-first insurance core platform that supported the complex product structure for innovative accumulator proposition, adaptable across various insurance product lines. The core platform also needed to integrate with a broad range of lifestyle ecosystem partners, creating a seamless and rewarding system that fosters customer loyalty, while offering the scalability to transact millions of policies per year.

The Solution

Digital-first Core Platform for Stackable Micro-Insurance

Income Insurance's innovative SNACK platform leverages Peak3’s Graphene core platform to streamline and enhance insurance operations. The platform manages the full value chain from product management to policy administration to claims. It is integrated with a range of data sources, systems and ecosystem partners to drive a seamless and fully automated customer experience.

SNACK offers term life, critical illness and personal accident protection, as well as investment linked insurance. Unlike traditional insurance models that rely on a fixed sum assured and coverage period, the SNACK platform allows for the accumulation of multiple micro-policies, with the sum assured progressively stacking over time—aligning with the platform's "accumulation" concept.

Graphene’s flexible multi-tier product structure and data model is the first-in-market solution to support such accumulator products with event-triggered micro-policies. The coverage dynamically adjusts based on the issuance or expiration of new micro-policies.

In addition, SNACK incorporates a gamified approach by integrating with dozens of ecosystem partners, such as banks, restaurants, shops, and digital platforms. When users transact with these partners, they can earn cashback, which is then invested into their insurance products. This model allows partners to "fund" their insurance protection, while rewarding and engaging customers in a new and innovative way, creating a unique value exchange.

The value of this disruptive innovation is clear: 75% of SNACK users are between 18 and 37 years old.

Income Insurance also uses Graphene for diverse other insurance propositions, ranging from usage-based motor insurance to embedded insurance scenarios to monthly life and health insurance subscriptions.

Peter Tay, Chief Digital Officer at Income Insurance

The Impact

Increased Customer Acquisition: Attracts a wider range of customers, particularly those deterred by traditional insurance costs and complexity.

Expanded Access to Insurance: Provides coverage to individuals with low or variable incomes, or those new to the workforce, who previously found insurance inaccessible.

Higher Engagement: The mobile-first, event-triggered product gamifies the experience with rewards and challenges, boosting user involvement and retention.

Portfolio Growth: Ongoing user contributions drive growth in both insurance and investment portfolios, enhancing coverage and returns.

Automate processes with Peak3 to save costs, enhance user experience, and scale operations on a single multi-tenant SaaS system.